Property made simple with TBA Law.

Free Report: 10 Mistakes to Avoid When Buying or Selling Real Estate

CONVEYANCING FOR VICTORIAN PROPERTIES

There is a lot of paperwork involved in transferring a property which can be daunting and a potential financial risk if it isn’t done correctly. If handled poorly, it can be highly stressful, when it should be one of the most exciting times of your life – buying or changing homes.

At TBA Law we take care of it all for you, including liaising with your bank over finance, and keeping you informed along the way. We will respond to your email or phone message within 24 hours, but usually the same day.

With the introduction of electronic conveyancing, many law firms now outsource a lot of the work, because they haven’t taken the time to learn it themselves. TBA Law was at the forefront of adopting the electronic PEXA platform, and we control every stage of the process ourselves.

We can handle your conveyancing in the towns where we work – Nagambie, Romsey, Wallan, Seymour – or any other place in Melbourne or rural Victoria.

Our guarantee: if your property purchase doesn’t settle, you won’t pay any legal fees.

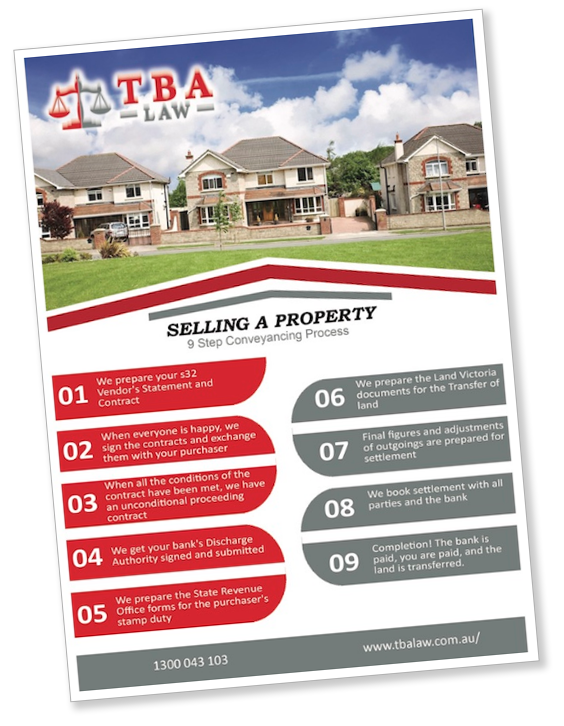

Find our more about our 9-step conveyancing process.

LEGAL ISSUES WE CAN HELP YOU WITH:

- Legal advice in regard to real estate contract law

- Drafting and reviewing contracts

- Auction contracts and purchases off-the-plan

- Subdivisions and house-and-land packages

- Property tenancy including joint tenants and tenants in common

- Vendor’s Statement, general conditions, and special conditions

- The cooling off period and deposits

- Put and Call Options

- Commercial property including leases

- Water trading, water shares and water rights

- Grazing Licences and Unused Road Licences

- Rural primary production property

- Liaison with financial institutions in regard to deposit bonds, loans, mortgages and discharges of mortgages

- Execution of contracts and settlement

- Adjustments to the purchase price in regard to rates and allowances

- Advice for first home buyers including the First Home Owner stamp duty concessions

- All aspects of conveyancing

- Husband to wife transfers

- Family farm transfers and stamp duty concessions

- Advice in regard to easements and covenants on title searches

- General law land

- Adverse possession

7 things to be aware of when buying a property

1. Vendor’s Statement

You should always see a Vendor’s Statement or “section 32” before making an offer on a property. Make sure you’re buying what you think you’re buying. We can look this over for you, if you like.

2. Read the Contract

It’s surprising how many people don’t! If it looks daunting, focus on the particulars pages and the special conditions. Otherwise, get us to look at it before you sign it.

3. Deposit

If the Contract says you have to pay a particular amount as a deposit, make sure you have that cash to pay. Speak to us if you don’t have the cash.

4. Borrowing

If you have to lend money from the bank to buy the property, make sure the Contract is conditional on you getting that loan approval. We can help with this, if you are unsure.

5. Cooling Off

You have 3 days to cool off on a Contract for residential property, unless you bought at auction. If you don’t get us the Contract within those 3 days, we can’t give you advice in case you need to take advantage of this cooling off right.

6. Goods

These are the items listed in the Contract that stay at the property when you buy it. Don’t assume anything – list everything you want to make sure stays at the property.

7. Budget

When working out what you can afford, make sure you find out what the stamp duty will be on your purchase, and whether you are entitled to any concessions, such as if you are going to live in the property as your principal place of residence.