Windfall Gains Tax in Victoria

Victoria’s new Windfall Gains Tax starts on 1 July 2023.

If land is rezoned, and it causes an increase in the value merely because of the rezoning, then the owner of the land must pay tax to the State Revenue Office.

If the rezoning doesn’t increase the value by more than $100,000, then the tax doesn’t apply.

If the rezoning increases the value between $100,000 and $500,000, then the owner pays 62.5% of the difference in tax!

If the rezoning increases the value by more than $500,000, then the owner pays the State 50% of the difference.

In Central Victoria, the most obvious rezoning is going to happen on the outskirts of townships, where farming land gets rezoned from Farming Zone to Low Density Residential Zone or General Residential Zone.

The farmer may apply for the rezoning, or may sell the farm to a developer subject to the rezoning. Yet, the farmer must pay. This might make more farmers reluctant to enter into deals with developers, unless they can pass the cost of the tax onto the developer. Then it may not have enough profit margin to entice a developer.

The follow on impact is also on a farmer whose land is rezoned without him wanting it to be – what a horrible impact! Not only is he facing being pushed off his farm by the expanding township, and paying much higher rates to stay there, but now he’s also lumped with 50% of the value increase as a tax.

Another example could be a Commercial Zone of Industrial Zone rezoned to Mixed Use Zone.

Or Township Zone rezoned to Low Density Residential Zone.

These rezoning may happen where there’s very little chance of development, and the owners of land just have to bear the change.

So when is the tax payable?

The Windfall Gains Tax must be paid within 30 days of the new valuation!

OR the owner has only 30 days to elect to defer the payment of the tax. The Windfall Gains Tax can be deferred until the land is later sold, or up to 30 years, whichever is the earlier.

If you’re aware of clients who are looking at developing their land, or entering into a deal with a developed, this new tax needs to be factored in.

If a development contract or contract for sale was entered into before 15 May 2021, then the arrangement is exempt. But anything from now on will be caught, if the rezoning happens after 1 July 2023.

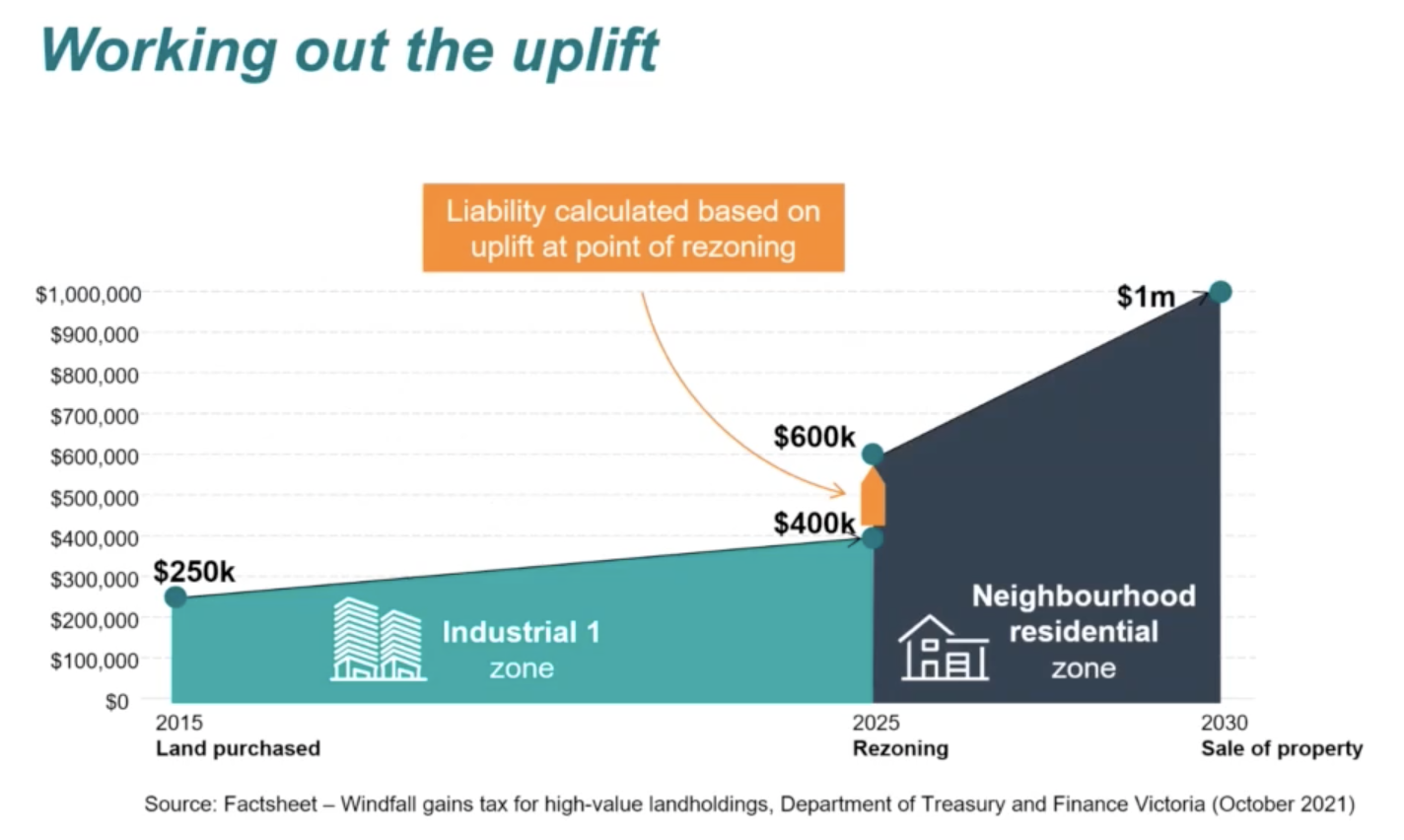

Here’s an example used by State government when they were bringing in this new legislation.

This example has a rezoning happening in 2025. The increase is $200,000, so the owner would pay (62.5% x $200k) $125,000 in taxable, payable immediately, even if the owner was still using his factory or workshed on the land and not selling it.

So someone like this needs to know they’ve only got 30 days to elect to defer to payment of the tax.

But a more dramatic example could be a farmer entering into an agreement with a developer to sell the land if it rezones – they sign this deal in May 2022. It rezones in February 2024, and the value of the land goes from $15m to $25m.

The farmer immediately has a tax bill of (50% x $10m) $5,000,000! How’s he going to pay that if he doesn’t get paid by the developer until the developer starts selling lots? He will also need to defer. He probably didn’t think about getting the developer to contribute to the tax, because the agreement was before 1 July 2023. The developer gets the benefit, but the farmer pays.

What sort of impact can you see this having on regional development?

Leave A Comment